Key takeaways:

Bitcoin (BTC) remains pinned below $120,000 after reaching a fresh all‑time high near $123,000 last week. As BTC price consolidates, numerous market analysts are convinced that the cycle is not over.

Here are the reasons why analysts think that the Bitcoin bull market has not peaked yet.

Bitcoin fundamentals remain strong

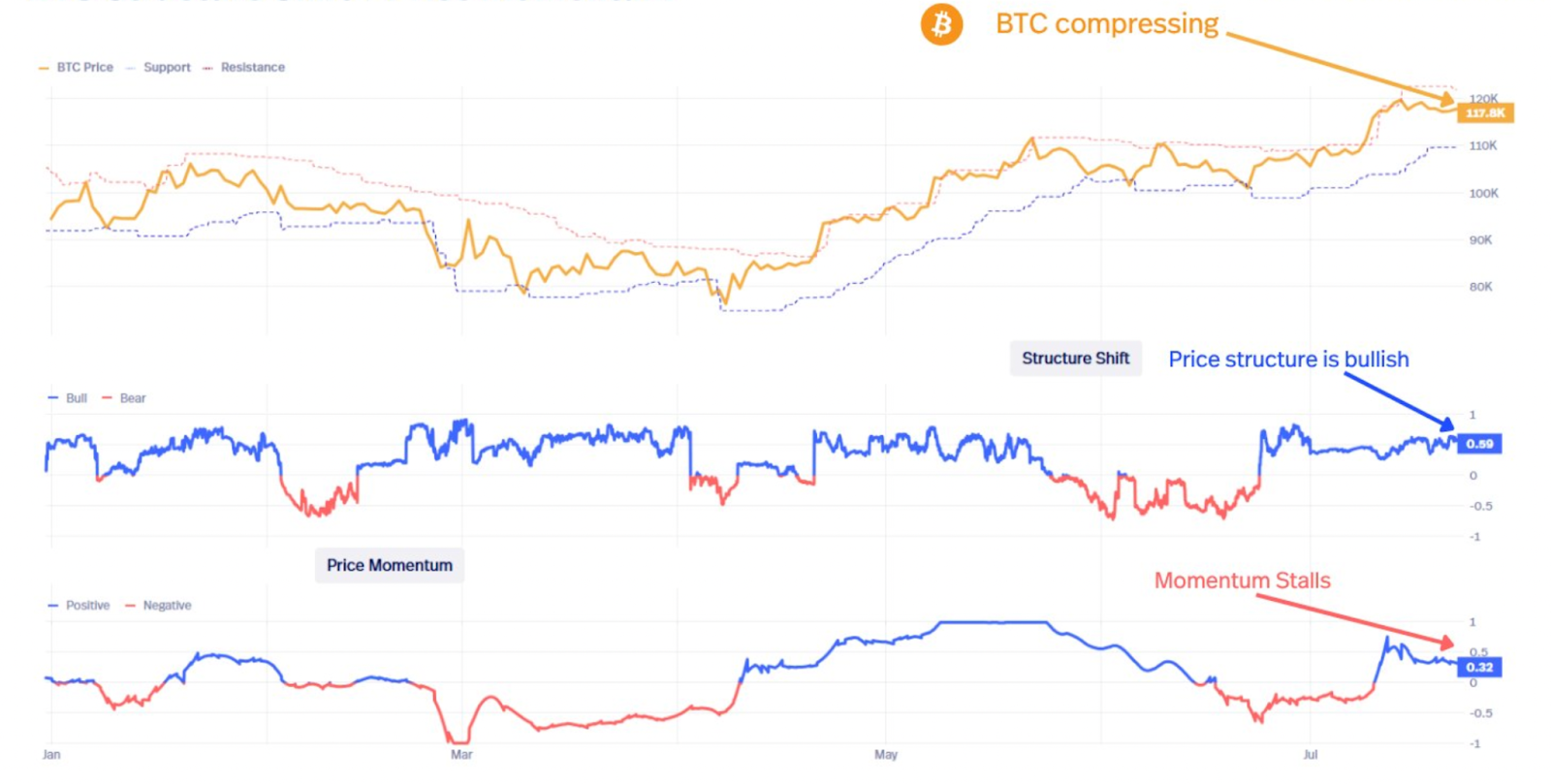

Analytics firm Bitcoin Vector said that although Bitcoin’s momentum has slowed, multiple onchain metrics suggest that Bitcoin’s cycle is not over.

“Momentum has cooled, but structure and fundamentals remain solid,” the firm said in a Tuesday post on X, adding:

“This isn’t a top. It’s a coiled setup with support beneath it.”

Related: New Bitcoin analysis says ‘most explosive phase’ to $140K is close

The Bitcoin Fundamental Index (BFI) remains strong, reflecting increasing network growth and liquidity, as shown in the chart below.

With BTC price compressed, “fundamentals are pausing, not weakening,” said Bitcoin Vector, adding:

“It’s the price that needs to catch up.”

In the short term, buyers could simply be waiting for confirmation of the breakout as Bitcoin plays the “structural anchor” for the whole crypto market, said private wealth manager Swissblock.

Meanwhile, BTC price is “holding a bullish structure” despite consolidating in a tight range between $116,500 and $120,000 since July 15. Bitcoin Vector added:

“No breakdown. No breakout. Just waiting for ignition. Once momentum aligns, the breakout continues.”

Onchain metrics suggest “room for expansion“

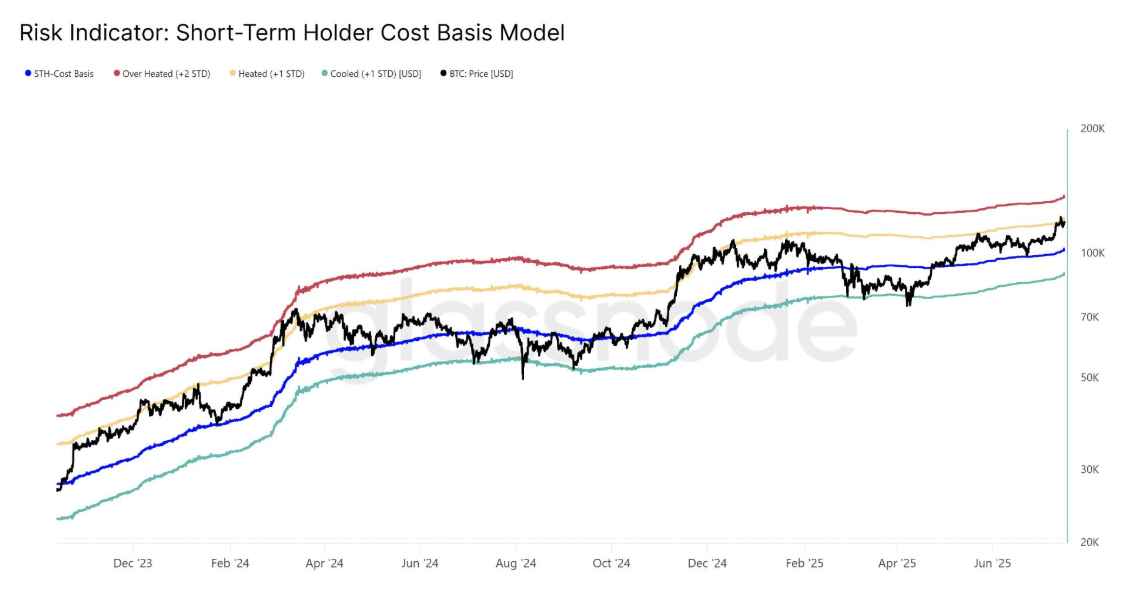

Looking at Bitcoin’s short-term holder (STH) cost basis, Swissblock said that the STHs are still active and not exhausted.

STH cost basis refers to the average purchase price of investors who have held Bitcoin for less than 155 days.

The price touched the “heated” band of this metric on July 14, when it hit its current all-time high, but did not enter the overheated zone.

If it rises to retest the upper band — matching the two standard deviations above the STH realized price — it could hit fresh all-time highs at $138,000.

“Profit-taking is present, but the STH risk zone at $138K hasn’t been reached,” Swissblock said, adding:

“This suggests there’s still room for expansion before we see any panic selling or euphoria.”

30 Bitcoin price top indicators say “hold 100%”

Bitcoin may be consolidating below the all-time highs, but CoinGlass’ bull market peak signals show no signs of overheating.

The bull peak signals refer to the selection of 30 potential selling triggers and aim to catch long-term BTC price tops. Currently, none of the indicators is flashing a top signal.

“0 out of 30 top signals have triggered on CoinGlass’s Bitcoin Bull Market Peak Dashboard,” analyst CryptosRus wrote in an X post on Monday.

CryptosRus, in particular, highlighted four long-term indicators — Pi Cycle Top, Market Value to Realized Value (MVRV), relative strength index (RSI) and Reserve Risk— to demonstrate that the Bitcoin bull market has plenty of room to go higher.

“Historically, the more boxes this list checks, the closer we get to a blow-off top. For now? Green lights.”

According to CoinGlass, Bitcoin is currently categorized as a “hold 100%” asset based on cues taken from the top 30 indicators.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.