Crypto market watchers are warning of a potential correction as whales offload billions of dollars in Bitcoin, even as the US Senate passes three major bills aimed at clarifying digital asset regulation.

A Satoshi-era whale awakened after 14 years of dormancy and moved $9.6 billion worth of Bitcoin (BTC), which he received in April and May of 2011, Cointelegraph reported on Thursday.

The whale may have opted to sell due to concerns related to the Guiding and Establishing National Innovation for US Stablecoins, or GENIUS Act, as the “US government moves to enforce audit requirements on stablecoins,” according to Jacob King, financial analyst and the CEO of WhaleWire.

“That alone will burst the biggest bubble and fraud in financial history: Bitcoin. It’s entirely propped up by fake money printed out of thin air,” he wrote in a Friday X post.

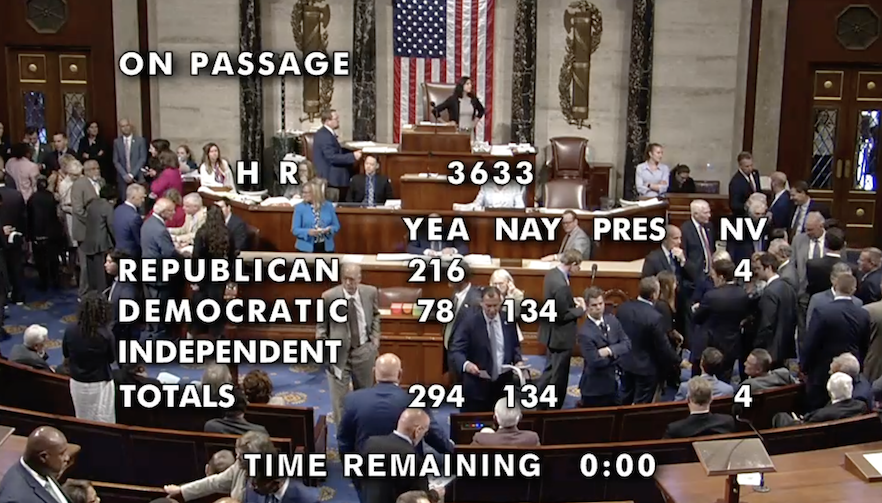

King’s comments come a day after US regulators passed three key cryptocurrency bills, including the GENIUS Act, in a 308-122 vote on Thursday.

Other industry watchers are more optimistic. According to Katalin Tischhauser, head of investment research at digital asset bank Sygnum, the GENIUS Act provides “clear regulatory frameworks and compliance pathways” for the “legal recognition of stablecoin as settlement instruments.”

Related: Arizona, Texas, Utah leading in US crypto policy: Chainlink

OG Bitcoin whales don’t care about regulations: Nansen analyst

Despite the initial concerns, long-term Bitcoin whales may not “care all too much about the bill,” according to Nicolai Sondergaard, research analyst at crypto intelligence platform Nansen.

“Even without regulation, you still held for several years and have now reached incredible levels of wealth,” he told Cointelegraph, adding:

“Eventually, one would wish to profit and make use of said wealth to enjoy the benefits, because what other reason is there to accumulate wealth?”

The Satoshi-era whale realized a more than 2.4 million percent increase over 14 years, after holding the Bitcoin stash since 2011, when BTC was trading below $30.

Related: Bitcoin treasury trend is new altseason for crypto speculators: Adam Back

“While the whale’s selling may not have occurred due to correction concerns, some investors may still await a pullback, explained the analyst, adding:

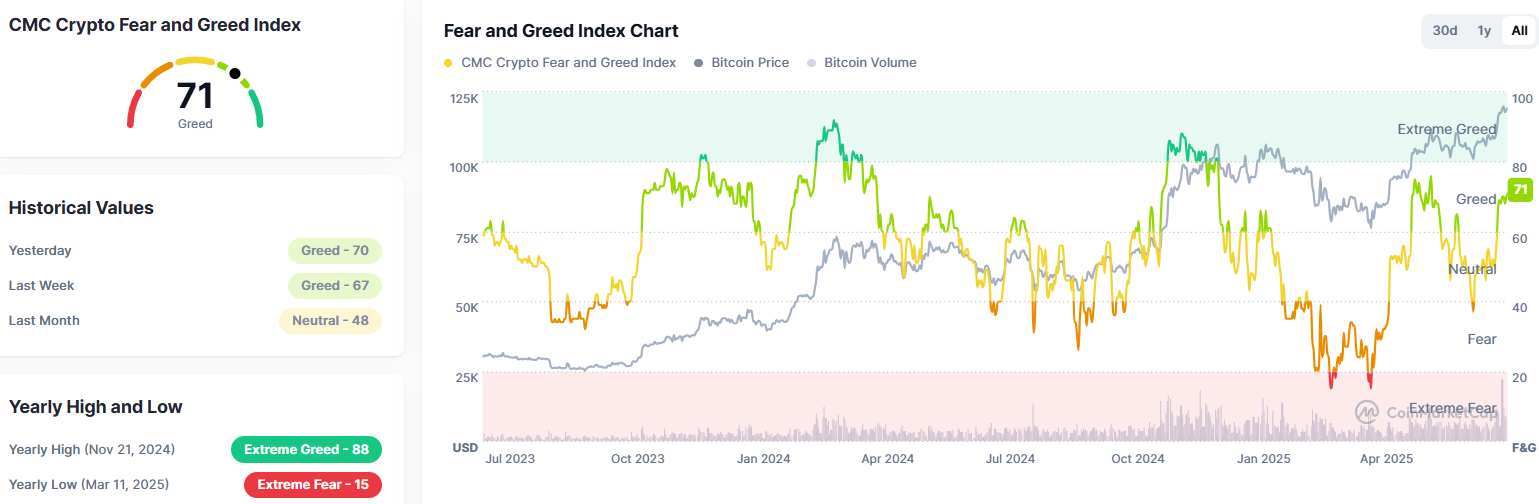

“We are seeing fear/greed indicators at 73, indicating some greed, but likely that many are still not fully allocated and are expecting at least some market turmoil or pullbacks.”

Nansen’s analysis of the options data indicates that the sentiment is “mildly bullish but still placing bets that cover both directions.”

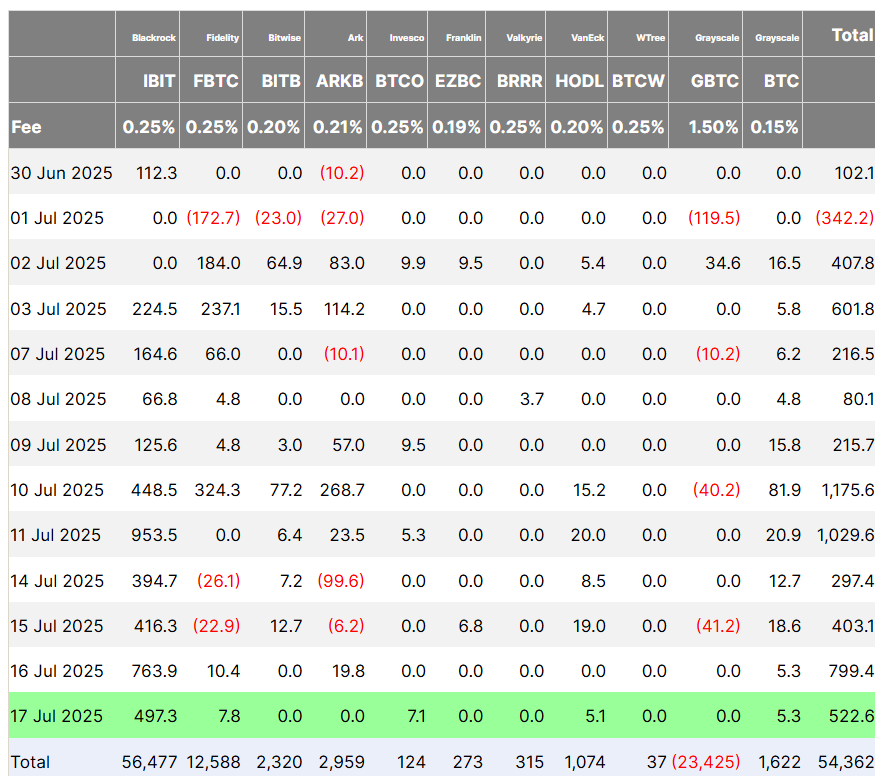

Meanwhile, the US spot Bitcoin exchange-traded funds logged the 11th consecutive day of net positive inflows, amassing over $522 million worth of investments on Thursday, Farside Investors data shows.

Magazine: Bitcoin OG Willy Woo has sold most of his Bitcoin — Here’s why