Key takeaways:

-

Bitcoin clears the $120,000 hurdle as long-term holder selling pressure eases.

-

Short-term holders are absorbing losses, signaling market stabilization.

-

Neutral LTH flows may set the stage for a decisive breakout.

Bitcoin (BTC) rallied above $120,000 for the first time since Aug. 13 as onchain data suggesting the market may be entering an accumulation phase as long-term holders (LTHs) selling pressure eases.

According to Glassnode, the Short-Term Holder Realized Value (RVT) ratio has been steadily compressing since May, reflecting a cooling of speculative excess. Historically, elevated RVT levels have coincided with overheated markets, while contractions toward the “full market detox” zone indicated that short-term traders are capturing fewer profits relative to overall network activity. If sustained, this trend could lay the groundwork for renewed accumulation as investors position for clearer market direction.

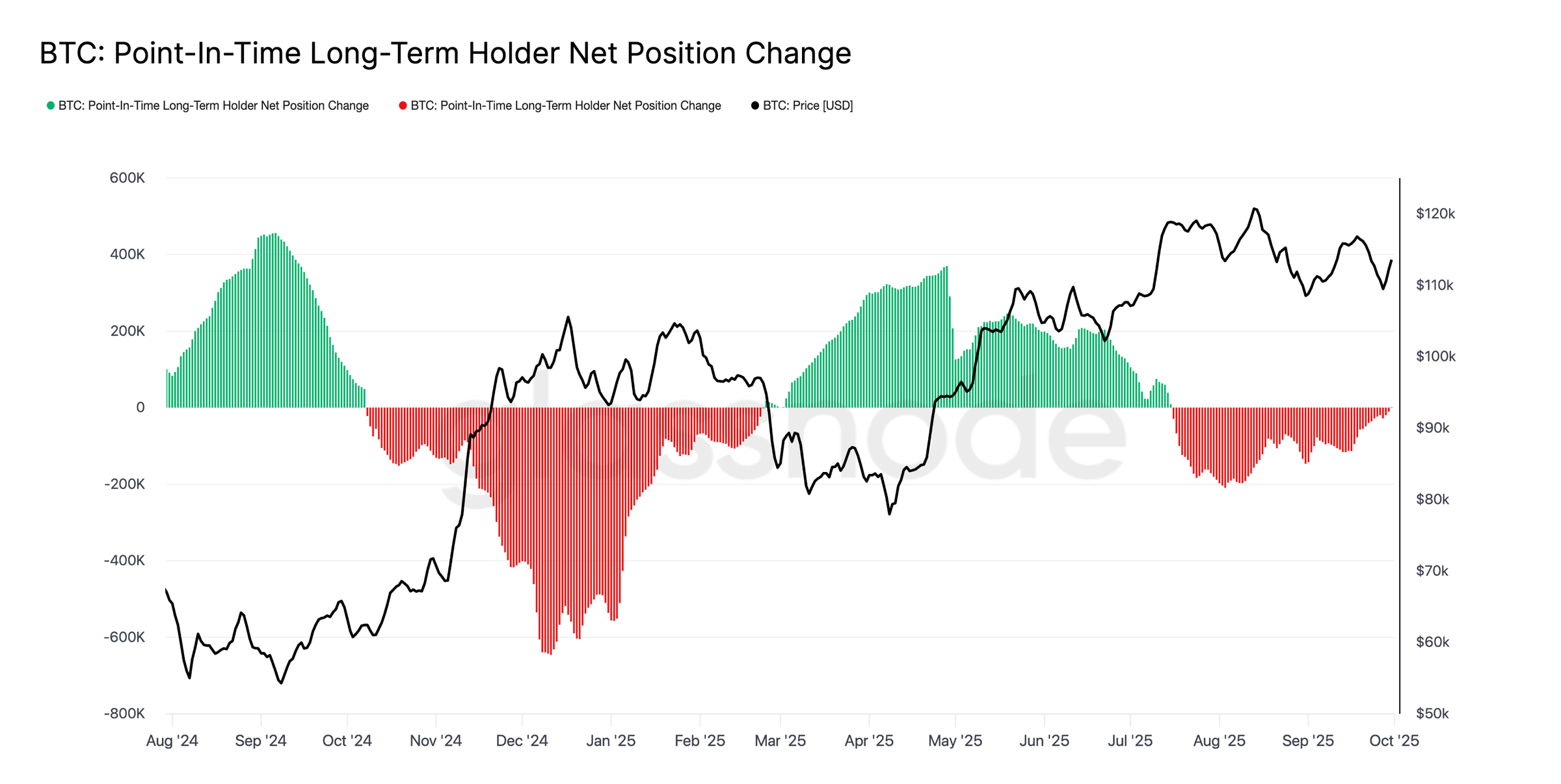

On the supply side, the balance between long-term holders and institutional inflows remained critical. After months of consistent distribution, data show that the Long-Term Holders Net Position Change (3D) metric has now shifted toward neutral territory.

This suggested that the heavy bout of profit-taking that capped recent rallies may be tapering off, potentially leaving exchange-traded funds (ETFs) and new inflows as the dominant drivers of near-term momentum.

If this cooling supply dynamic holds, Bitcoin could be forming a structural base in the $115,000 to $120,000 zone, similar to the consolidation phase observed in March and April, when neutralized LTH flows preceded a sharp upward continuation.

With LTH distribution waning and short-term excess unwinding, analysis suggested the market may be preparing for a decisive breakout attempt, with $120,000 emerging as the key threshold to watch.

Related: Bitcoin’s next ‘explosive’ move targets $145K BTC price: Analysis

Short-term holder losses show signs of absorption

While long-term supply dynamics appear to be cooling, short-term investor behavior also flashed important signals. According to CryptoQuant, short-term holders (STHs) have recently undergone a period of stress, with the STH-SOPR dipping as low as 0.992 through September. This marked a phase where speculative wallets consistently realized losses, often a sign of weak hands exiting the market.

However, last week, the metric rebounded slightly to 0.995, still below August’s 0.998, but signaling early stabilization.

Historically, such resets tend to play out in two ways: extended loss realization that drives corrective phases, or a “healthy reset” where selling pressure is quickly absorbed. With BTC comfortably consolidating above $115,000, the recovery in STH-SOPR could be a potential marker of market resilience ahead of a new bullish leg.

Related: Bitcoin bulls charge at $120K with traders expecting new all-time high

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.