The Federal Reserve, the central bank of the United States, is expected to begin slashing interest rates on Wednesday, with analysts expecting a 25 basis point (bps) cut and a boost to risk asset prices in the long term.

Crypto prices are strongly correlated with liquidity cycles, Coin Bureau founder and market analyst Nic Puckrin said. However, while lower interest rates tend to raise asset prices long-term, Puckrin warned of a short-term price correction.

“The main risk is that the move is already priced in, Puckrin said, adding, “hope is high and there’s a big chance of a ‘sell the news’ pullback. When that happens, speculative corners, memecoins in particular, are most vulnerable.”

Most traders and financial institutions expect at least two interest rate cuts in 2025, including investment bank Goldman Sachs and banking giant Citigroup, which both expect three cuts during the year.

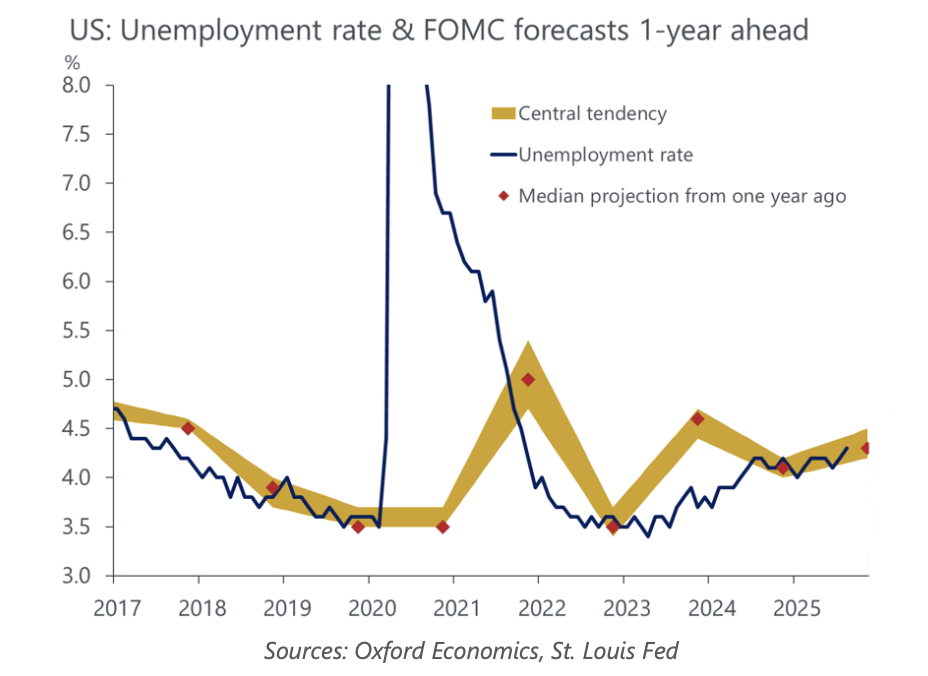

Oxford Economics, an advisory company, forecast a maximum of two interest rate cuts in 2025. Ryan Sweet, chief US economist at the company, said the three cuts were “overly optimistic,” despite the Federal Reserve slashing rates earlier than expected.

The crypto community and investors across markets have been anticipating interest rate cuts following downward revisions of over 900,000 jobs for 2025, signaling a weakening job market in the US and deteriorating macroeconomic fundamentals.

Related: Crypto markets prepare for Fed rate cut amid governor shakeup

A 25 BPS cut may create a short-term rally, but 50 BPS is a bridge too far

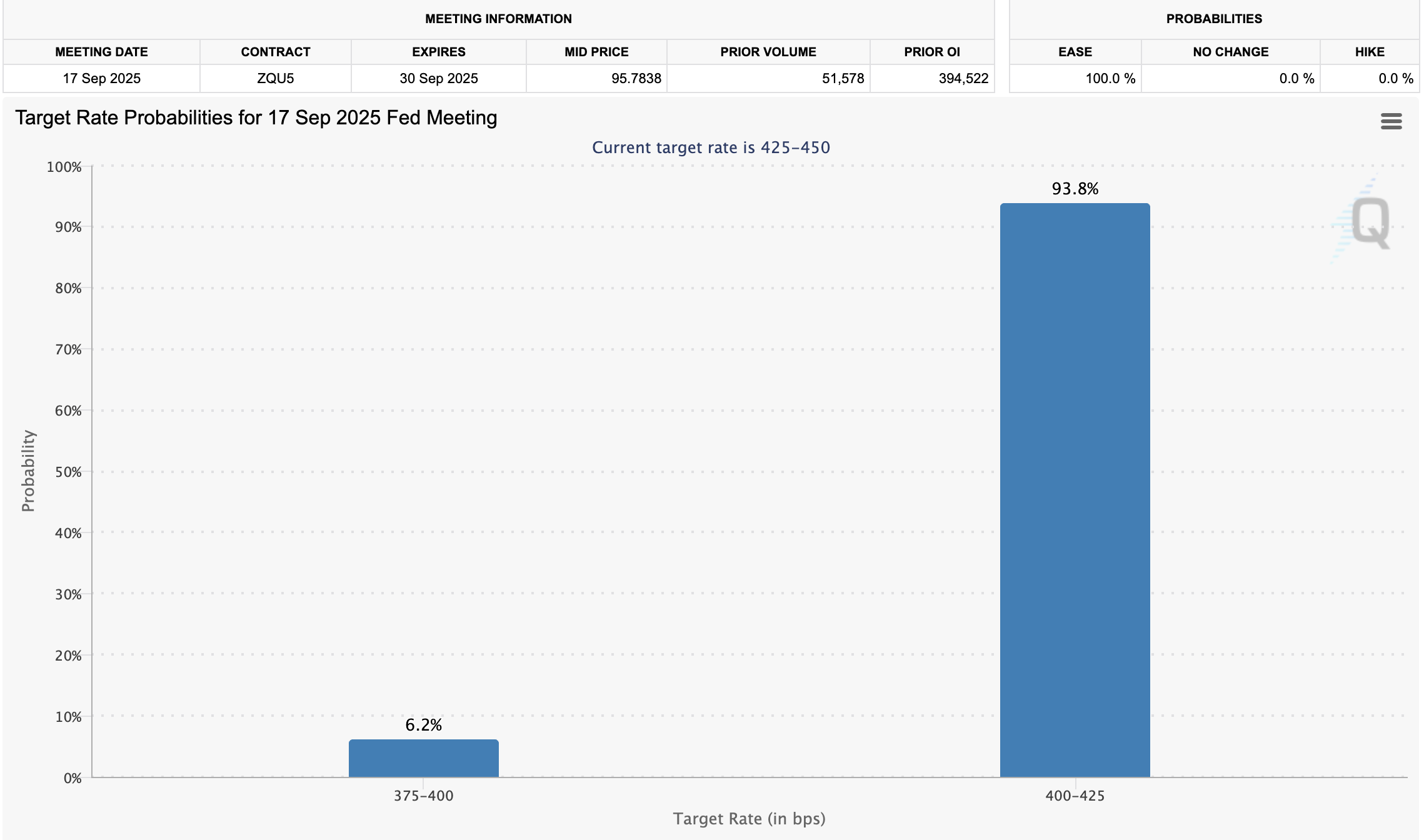

According to the Chicago Mercantile Exchange (CME) Group, 6.2% of traders expect the Federal Reserve to slash interest rates by 50 BPS on Wednesday.

A 25 BPS cut would spark a “brief rally” in risk-on assets, Javier Rodriguez-Alarcon, chief investment officer at digital asset investment company XBTO, said.

“A 50 bps surprise, by contrast, would heighten concerns over the health of the economy and underlying growth, weighing on markets in the short term, Rodriguez-Alarcon said.

However, the cuts will ultimately boost asset prices in the long term as investors exit cash to pursue investments, he said.

Magazine: Bitcoin to see ‘one more big thrust’ to $150K, ETH pressure builds: Trade Secrets