Key takeaways:

XRP (XRP) is flashing multiple technical and onchain signals, suggesting that a rally to $6 is possible over the next few weeks. Key developments surrounding Ripple and a surge in XRP futures demand are making the case for further upside.

Increasing OI backs XRP’s upside

XRP price rose alongside other altcoins on Wednesday, fueled by a number of factors, including the end of the legal battle between Ripple, the blockchain company behind XRP, and the US Securities and Exchange Commission.

🔥 UPDATE: The SEC has issued a Litigation Release announcing the resolution of its case against Ripple. pic.twitter.com/uAKQC872vi

— Cointelegraph (@Cointelegraph) August 12, 2025

Riding with the wave, XRP price rose as much as 6.8% to an intraday high of $3.31 on Wednesday from a low of $3.10 the day before.

Related: Is XRP ‘way overvalued’ to buy right now?

The open interest also climbed 9.5% over the last 24 hours and 24% over the last 10 days to $8.68 billion at the time of writing, signaling the return of derivatives traders.

Futures OI increasing alongside the price indicates new money entering the market, particularly from institutional investors.

Meanwhile, XRP’s daily funding rate was positive at 0.04%, suggesting that most traders were taking long positions, anticipating further upside.

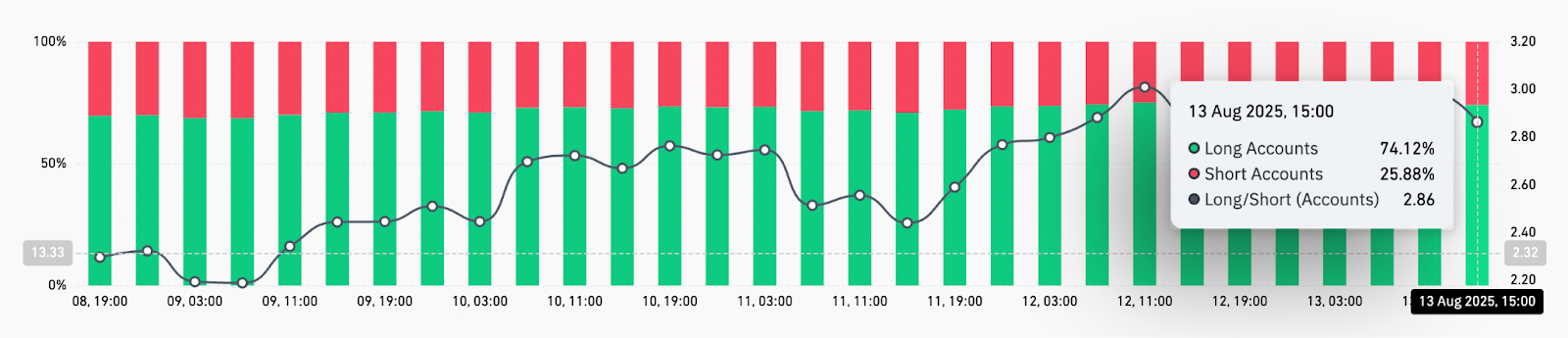

XRP’s ratio of long/short accounts on Binance is currently skewed toward bullish positions at 74%. While this heightened activity introduces liquidation risks, it underscores rising confidence in XRP’s upside potential..

XRP price charts target over $6

The daily chart shows that XRP price trading is still validating a bull flag, with the price facing resistance from the multi-year high at $3.66.

A daily candlestick close above this area will clear that path for XRP’s rise toward the bull flag’s target at $5.80, representing a 77% increase from the current price.

Zooming out, XRP’s price has formed a rounded bottom chart pattern on the weekly chart (see below). Bulls are now focused on pushing above the chart pattern’s neckline at $3.40.

A daily candlestick close above this level would confirm a bullish breakout from the rounded bottom, ushering XRP into price discovery with the technical target set at $6.70, or a 102% increase from the current level.

The relative strength index, or RSI, is at 64, suggesting that the market conditions are not yet overheated.

As Cointelegraph reported, XRP’s breakout from a seven-year double-bottom structure could result in a 10x increase in price if history repeats.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.