Today in crypto, US SEC Chair Paul Atkins unveiled a regulatory agenda that could reshape digital asset rules. Wintermute seeks regulatory clarity on network tokens and Coinbase CEO Brian Armstrong says he wants half the platform’s code written by AI.

SEC’s agenda proposes crypto safe harbors, broker-dealers reforms

US Securities and Exchange Commission (SEC) Chair Paul Atkins has released a regulatory agenda containing proposed rules that could significantly affect how the agency handles digital assets.

In a Thursday notice, the SEC released about 20 proposed rules as part of its spring 2025 agenda. Though each proposal varies in terms of the potential impact on the crypto industry, many suggested that the commission would continue to soften its enforcement approach, establishing safe harbors and restructuring existing regulations to benefit projects.

“The agenda covers potential rule proposals related to the offer and sale of crypto assets to help clarify the regulatory framework for crypto assets and provide greater certainty to the market,” said Atkins.

Among the proposed rules in the SEC agenda was including “certain exemptions and safe harbors” related to the offer and sale of crypto assets, and amending the Exchange Act “to account for the trading of crypto assets on [alternative trading systems] and national securities exchanges.

The modifications could allow crypto companies to operate with less regulatory oversight and reduce the risk of legal action.

Other proposals suggested modifying “broker-dealer financial responsibility rules,” which could lessen the burden on crypto companies reporting data.

Broker-dealer rules have been a point of contention for many in the crypto industry by placing Know Your Customer and Anti-Money Laundering regulations on networks, often without the means to gather such data.

Wintermute urges SEC to exclude network tokens from securities rules

Trading firm and market maker Wintermute has urged the US Securities and Exchange Commission (SEC) to clarify that network tokens should not fall under securities regulations. The company made its case in a formal response to the agency’s request for comment.

Wintermute argued that regulatory certainty is vital to prevent the misapplication of securities laws and to support the continued development of crypto markets. Without such clarity, the firm warned, innovation and adoption in the sector could face unnecessary hurdles.

The company emphasized that network tokens — such as Bitcoin (BTC) and Ether (ETH) — serve as essential technical components for blockchain operations. Unlike financial products, these tokens are inherently tied to the functioning of decentralized networks and should not be classified as securities.

Coinbase CEO wants AI to write 50% of his platform’s code by October

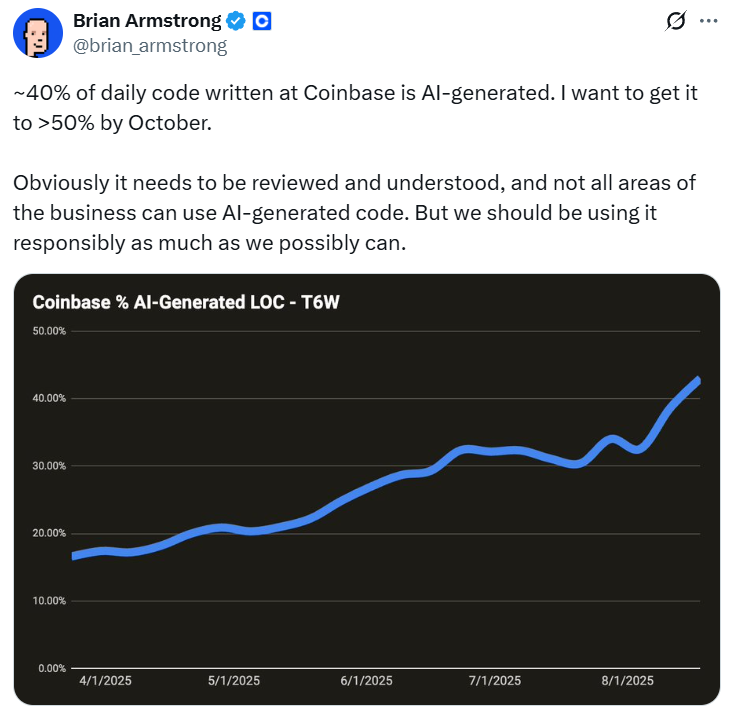

Over 40% of Coinbase’s code is written by artificial intelligence, according to CEO Brian Armstrong, who hopes the figure will rise to 50% by next month.

“Obviously it needs to be reviewed and understood, and not all areas of the business can use AI-generated code. But we should be using it responsibly as much as we possibly can,” Armstrong posted to X on Wednesday.

The percentage of AI-generated lines of code at Coinbase has more than doubled since April, according to the chart he shared.

His comments come about a month after Coinbase said one of its biggest focuses is to transform its workforce into “AI-Natives” — signaling it doesn’t plan to replace a significant share of its 4,200 employees with AI anytime soon.