Former kickboxing champion and controversial influencer Andrew Tate is once again back to cryptocurrency trading, after a financial loss on Kanye West’s YZY token.

Andrew Tate’s long position on the Trump family-linked World Liberty Financial (WLFI) token was liquidated for a total loss of $67,500 earlier Tuesday on decentralized exchange Hyperliquid.

Despite the Loss, Tate continued betting on the WLFI token’s price appreciation, “immediately” opening another long position, according to blockchain data platform Lookonchain in a Tuesday X post.

The liquidation occurred less than two weeks after Tate opened a 3x leveraged short position on the Kanye West-linked YZY token, as his cumulative losses neared $700,000 on a single Hyperliquid account.

Tate’s loss came a day after the Trump family-tied decentralized finance project World Liberty Financial’s WLFI token started trading on exchanges on Monday.

WLFI fell about 36% after listing, from a peak of $0.331 to a low of $0.210, before recovering slightly to trade above $0.2420 as of 8:42 am UTC. The WLFI token is down over 21% since launch, CoinMarketCap data shows.

Related: Crypto in US 401(k) retirement plans may drive Bitcoin to $200K in 2025

A significant token unlock added 24.6 billion tokens to WLFI’s circulating supply on Monday, increasing the Trump family’s holdings to $5 billion.

The project previously said that the WLFI allocations will be initially locked for the founders, including Donald Trump and his three sons, Donald Trump Jr., Barron Trump and Eric Trump.

Related: Ether trader nearly wiped out after epic run from $125K to $43M

WLFI floats token buyback proposal after 36% dip

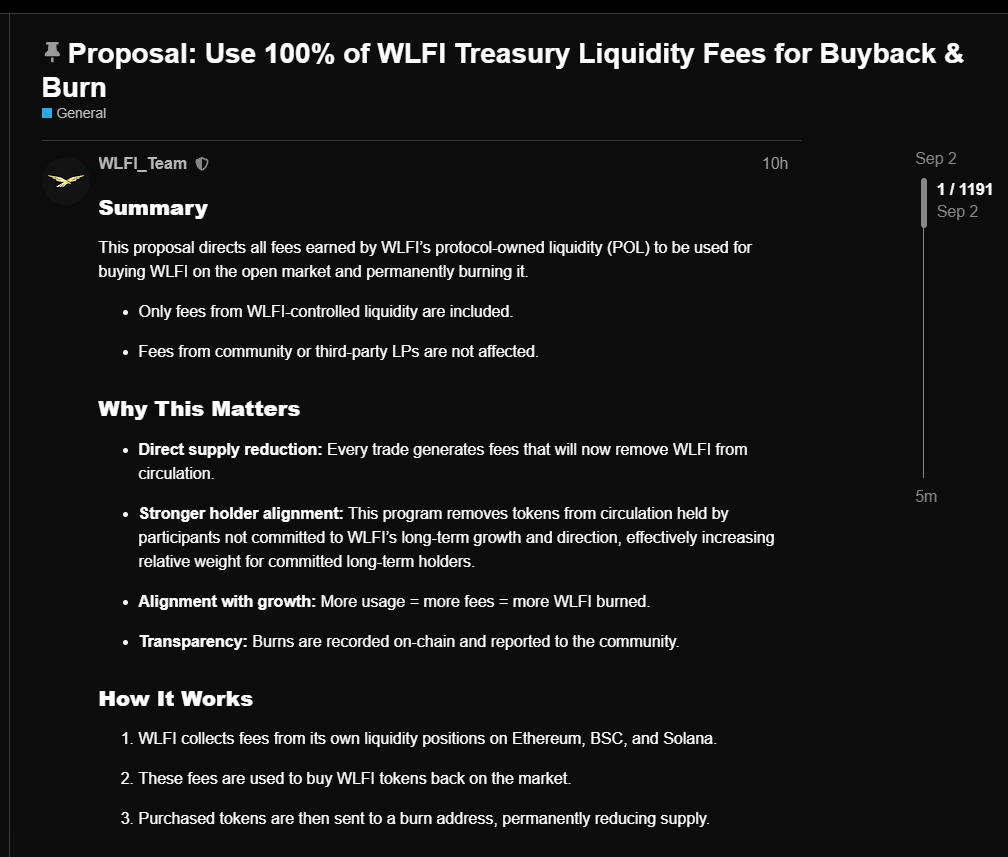

Following the WLFI token’s post-launch dip, the platform issued a new governance proposal to implement a token buyback and burn program using protocol-owned liquidity fees.

WLFI proposed using 100% of protocol fees generated from the platform’s own liquidity positions across Ethereum, BNB Chain and Solana to buy back WLFI tokens from short sellers on the open market and permanently remove them from circulation via burning.

Similar mechanisms seek to reduce the circulating supply of a token and create more demand through buybacks.

At publication, the majority of respondents had expressed support for the governance proposal.

Still, the proposal doesn’t include the platform’s generated fee amounts, making it difficult to estimate the potential market impact the token buybacks will have on WLFI.

Magazine: Bitcoin is ‘funny internet money’ during a crisis: Tezos co-founder