Key Takeaways

VIRTUAL’s Spot and Futures data suggested accumulation as its price approached the $0.80 gap, keeping the $5.12 target in play despite volatility risks.

Virtual Protocol’s [VIRTUAL] trajectory has been impressive since its launch, surging from $0.0300 to $5.12 in less than a year. The staggering move has majorly been on the backs of retail traders and whales.

Even now, VIRTUAL’s chart continues to carry a bullish tone. On the weekly time frame, traders are eyeing the next possible swing high near $5.12.

VIRTUAL: Technical setup looks bullish

One of the more interesting details in VIRTUAL’s weekly chart is the $0.40 rejection zone that kicked off the rally. That move left behind a visible gap around $0.80, which the current pullback seems to be testing.

How price reacts here will be critical.

If buyers defend the significant market gap, VIRTUAL could witness a successful reversal for further bullish momentum in favor of another breakout, and can test the next resistance level at $5.12.

Whale accumulation picks up

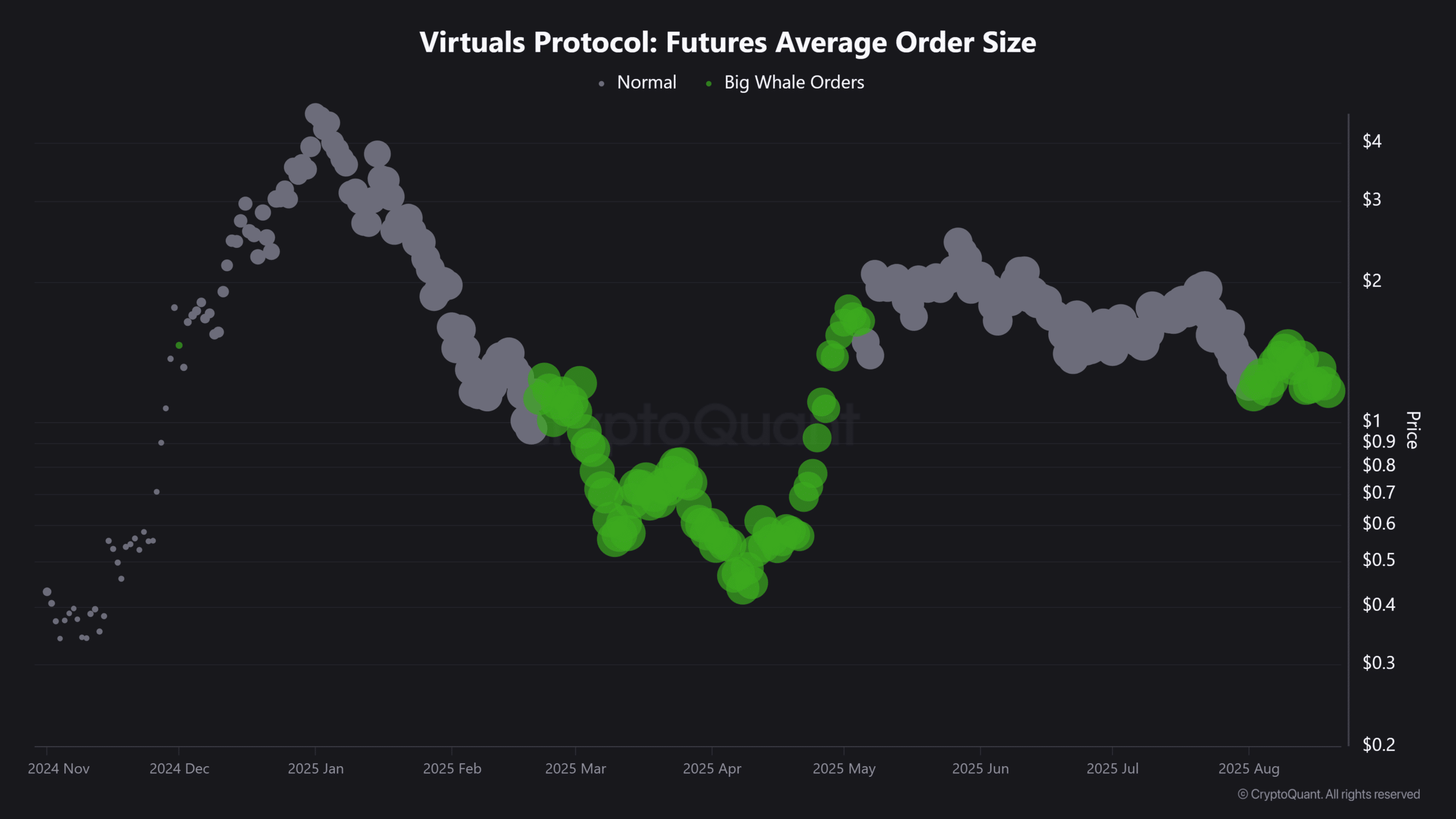

AMBCrypto’s analysis of VIRTUAL’s on-chain data showed that whales were actively positioning themselves.

Large players have been steadily accumulating orders in the Spot market, reinforcing the $0.80 level as a strong potential support.

Whale and institutions are eyeing the gap as a key turning point for the bullish run continuation.

Similarly, leveraged long positions are building at current prices in the Futures market, also reflecting growing confidence in VIRTUAL’s upward trajectory.

Can Virtual gain 10X?

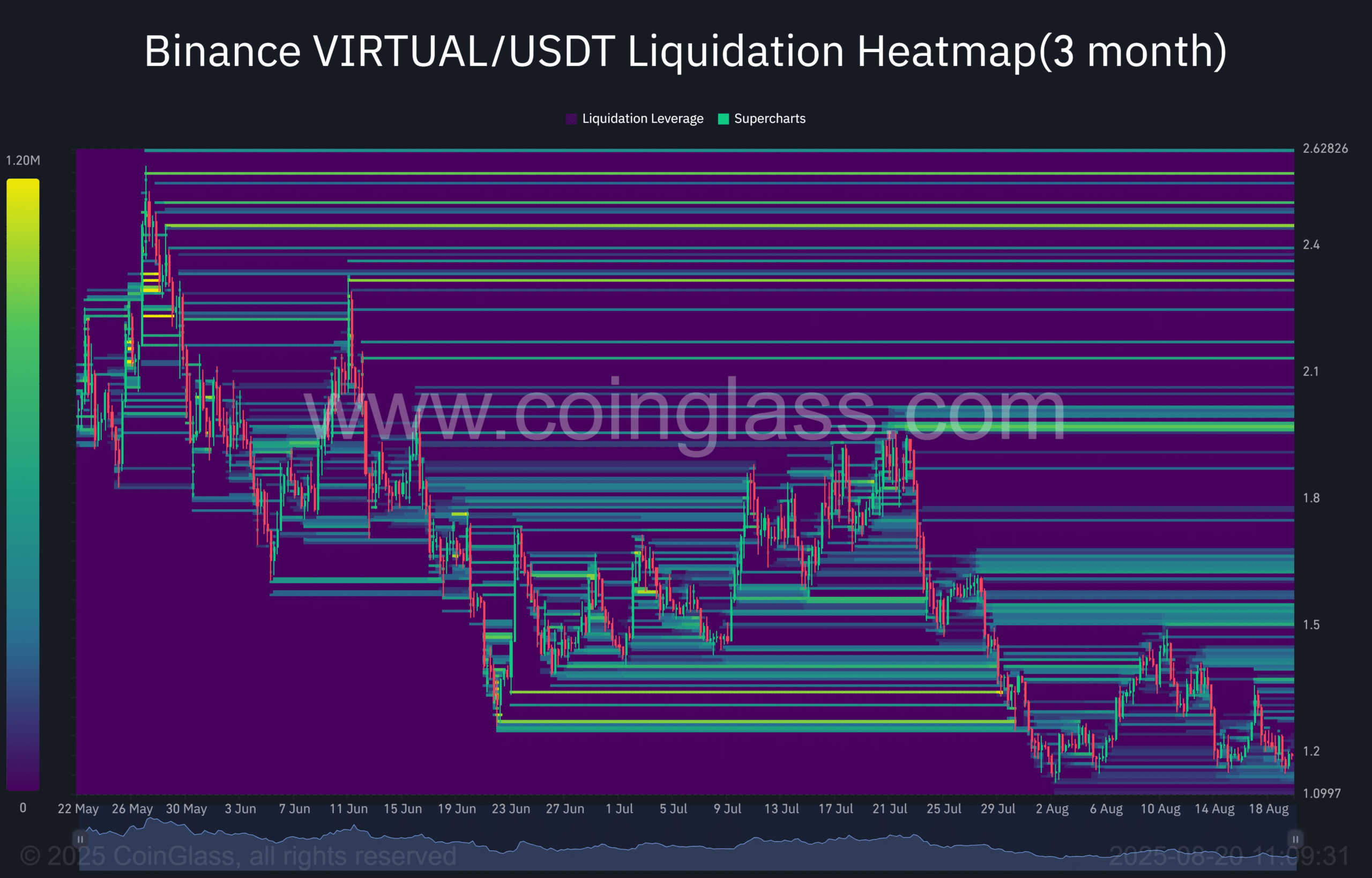

If the $0.80 demand zone holds firm, VIRTUAL’s rally toward the $5.12 swing high is increasingly likely. CoinGlass’ liquidity heat map data indicated a cluster of liquidity on the longer time frame, adding to the bullish bias.

Clearing this level could fuel VIRTUAL’s rise beyond $0.80, and potentially rise 10X.

But despite the metrics ticking all the bullish boxes, the bearish risks cannot be ignored.

Given that the markets rarely move in a straight line, any slip in whale support or a sharp round of profit-taking could stall the momentum.

Still, with both VIRTUAL technicals and on-chain activity leaning bullish, the future of the token remains uncertain.