Trading volume on the decentralized exchange Hyperliquid reached a new monthly high in July, setting a record among DeFi perpetual futures platforms as user activity continued to rise.

According to DefiLlama data, the platform processed $319 billion in trades during the month — the highest monthly volume ever recorded in the DeFi perpetual futures space.

Hyperliquid’s record is a sign of more traders using decentralized exchanges, which are starting to cut into the market share of centralized cryptocurrency exchanges (CEXs).

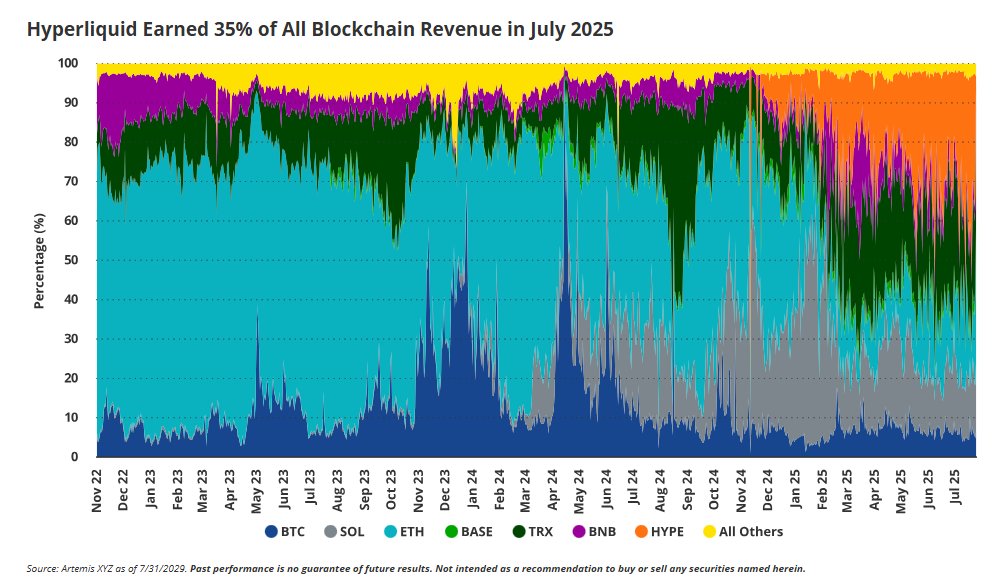

Hyperliquid earned 35% of all blockchain revenue during July, capturing significant value at the expense of Solana, Ethereum and BNB Chain, VanEck researchers said in a monthly crypto recap report.

“Hyperliquid was able to capture much of Solana’s momentum, and likely Solana’s market capitalization, because it offers a simple, highly functional product,” VanEck head of digital assets research, Matthew Sigel, and fellow analysts Patrick Bush and Nathan Frankovitz, said in the report.

The milestone comes despite Hyperliquid suffering an outage that saw traders sidelined for about 37 minutes on July 29. The derivatives platform reimbursed affected users a total of $2 million, receiving community praise for the rapid response.

Crypto perpetual futures enable traders to speculate on cryptocurrency prices without expiration dates.

Related: Crypto treasuries top $100B for Ethereum’s 10th anniversary: Finance Redefined

DeFi perps near $500 billion record volume amid Hyperliquid’s growth

Hyperliquid’s rapid growth pushed the collective trading volume of DeFi perpetual exchanges to a new monthly high of $487 billion in July, marking a 34% increase from the $364 billion recorded in June, DefiLlama data showed.

EdgeX was the second-largest platform with a $21 billion monthly trading volume, followed by MYX Finance with over $9 billion of volume for the month of July.

Related: Crypto funds see $223M outflow, ending 15-week streak as Fed dampens sentiment

Hyperliquid, the world’s seventh-largest derivatives exchange by daily trading volume, has reached over 604,400 registered users — an increase from 488,000 recorded on June 6, according to data from Dune.

Hyperliquid gained popularity in April 2024 after launching spot trading with an aggressive listing strategy and easy-to-navigate user interface.

Trade Secrets: Metric signals $250K Bitcoin is ‘best case,’ SOL, HYPE tipped for gains