Bitcoin miner MARA Holdings beat analyst expectations in its second-quarter earnings, which saw its share price slightly gain after-hours.

MARA Holdings’ revenues increased 64% year-on-year to $238 million, up from $145 million in Q2 2024 and also gaining from its $214 million revenues in the first quarter of 2025, the company said on Tuesday.

The firm’s revenue beat analyst expectations of $223.7 million while its net income surged 505% compared to a year ago to $808 million, up from a loss of just under $200 million in Q2 2024.

The income gain was largely driven by a $1.2 billion unrealized gain from Bitcoin (BTC) appreciation over the period. The asset gained 31% over the three-month period ending June 30.

MARA shares gain after hours

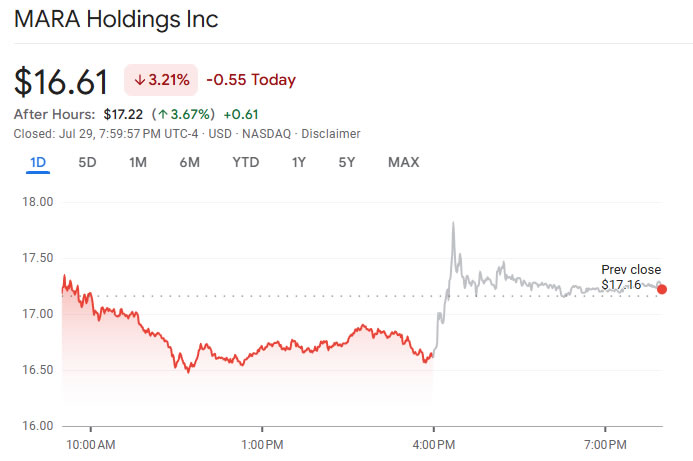

With its earnings release, shares in MARA Holdings (MARA) spiked to a high of 7.5% in after-hours trading on Tuesday to $17.82 before cooling to $17.22.

MARA closed Tuesday trading down 3.2% at $16.61. Its shares have gained 58% since a slump in mid-April but have largely traded sideways for most of this year.

Second-largest Bitcoin treasury

MARA said that shortly after the end of Q2, its Bitcoin holdings surpassed 50,000 BTC, which it touted as “solidifying our position as the second-largest corporate public holder of Bitcoin” behind MicroStrategy.

During the second quarter, MARA mined 2,358 BTC, up 3% from the 2,286 produced in the previous quarter. Its energized hashrate of 57.4 exahashes per second (EH/s) gained 6% from 54.3 EH/s in Q1.

Related: Mara to raise up to $1B for Bitcoin and operations via debt sale

The firm’s Bitcoin holdings increased 170% to 49,951 BTC, worth around $5.3 billion as of the end of June. It currently holds $5.87 billion worth of the asset and is second only to Strategy, which holds a whopping 607,770 BTC worth $71 billion.

Eyes on AI growth

The firm also announced strategic partnerships with Google-backed TAE Power Solutions and LG-backed PADO AI to co-develop grid-responsive, load-balancing platforms for next-generation AI infrastructure.

MARA is targeting 75 EH/s by year-end and sees a significant opportunity in the growing AI and data center market.

“Our vertically integrated mining operations, large BTC treasury, budding international energy partnerships, and early AI infrastructure investments each contribute distinct and measurable value,” said CEO Fred Thiel.

Magazine: Robinhood’s tokenized stocks have stirred up a legal hornet’s nest