Key Takeaways

- Chainlink’s bullish structure faces a key test at $17.50. Spot market dominance and rising Open Interest support the rally, while on-chain metrics like MVRV and NVT signal risk of overheated conditions. Caution remains near resistance.

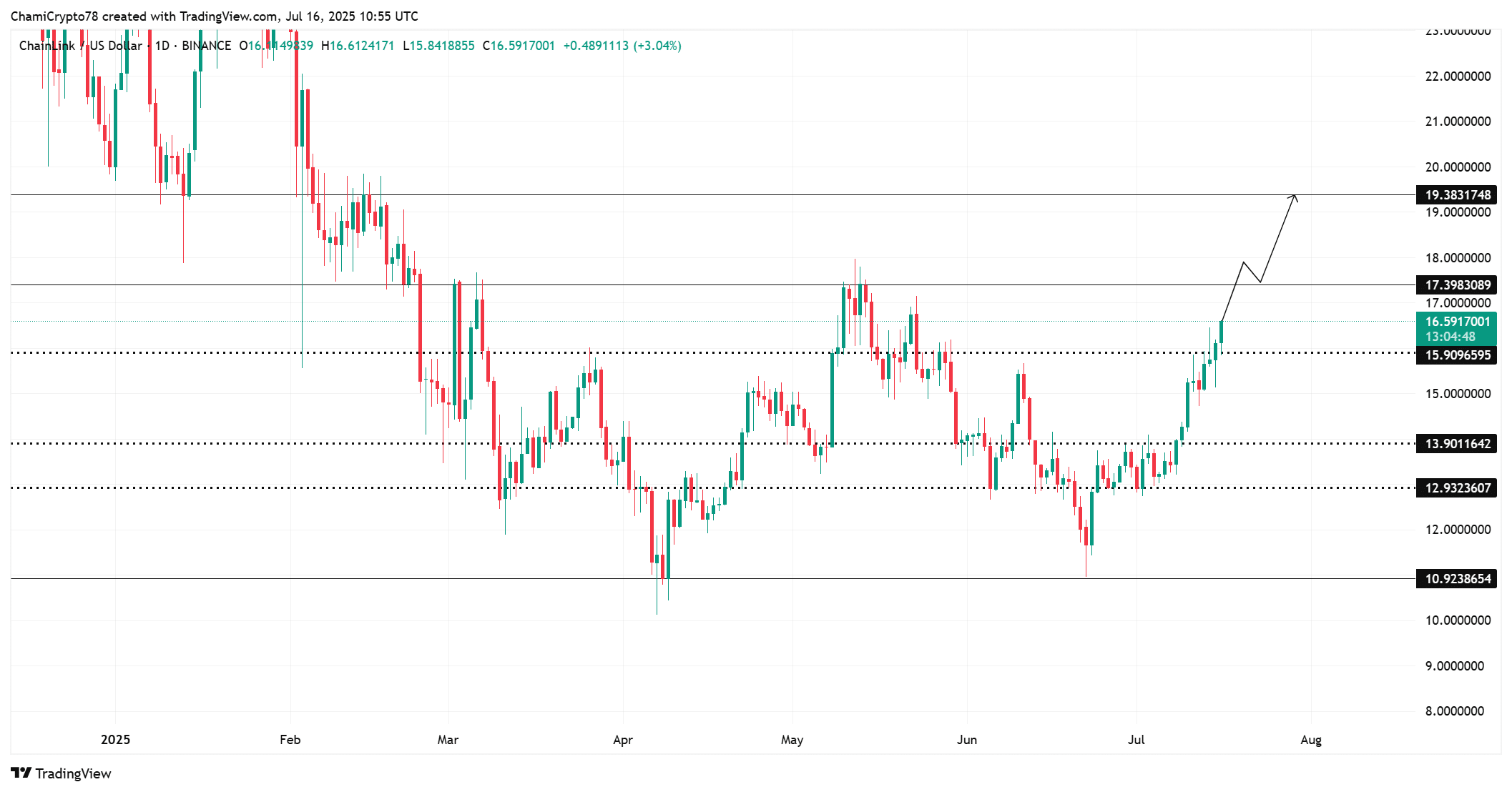

Chainlink [LINK] extended its uptrend, forming a clear bullish structure as it climbs toward a critical resistance at $17.39.

After reclaiming the mid-range at $15.90, LINK formed higher lows and highs, showing consistent buyer strength.

At press time, LINK traded at $16.59, closing in on a level that has capped past rallies.

While the price tested this resistance before, that rally failed. The question now: Will this retest spark a breakout or another drop?

Can sustained spot demand drive LINK above its resistance wall?

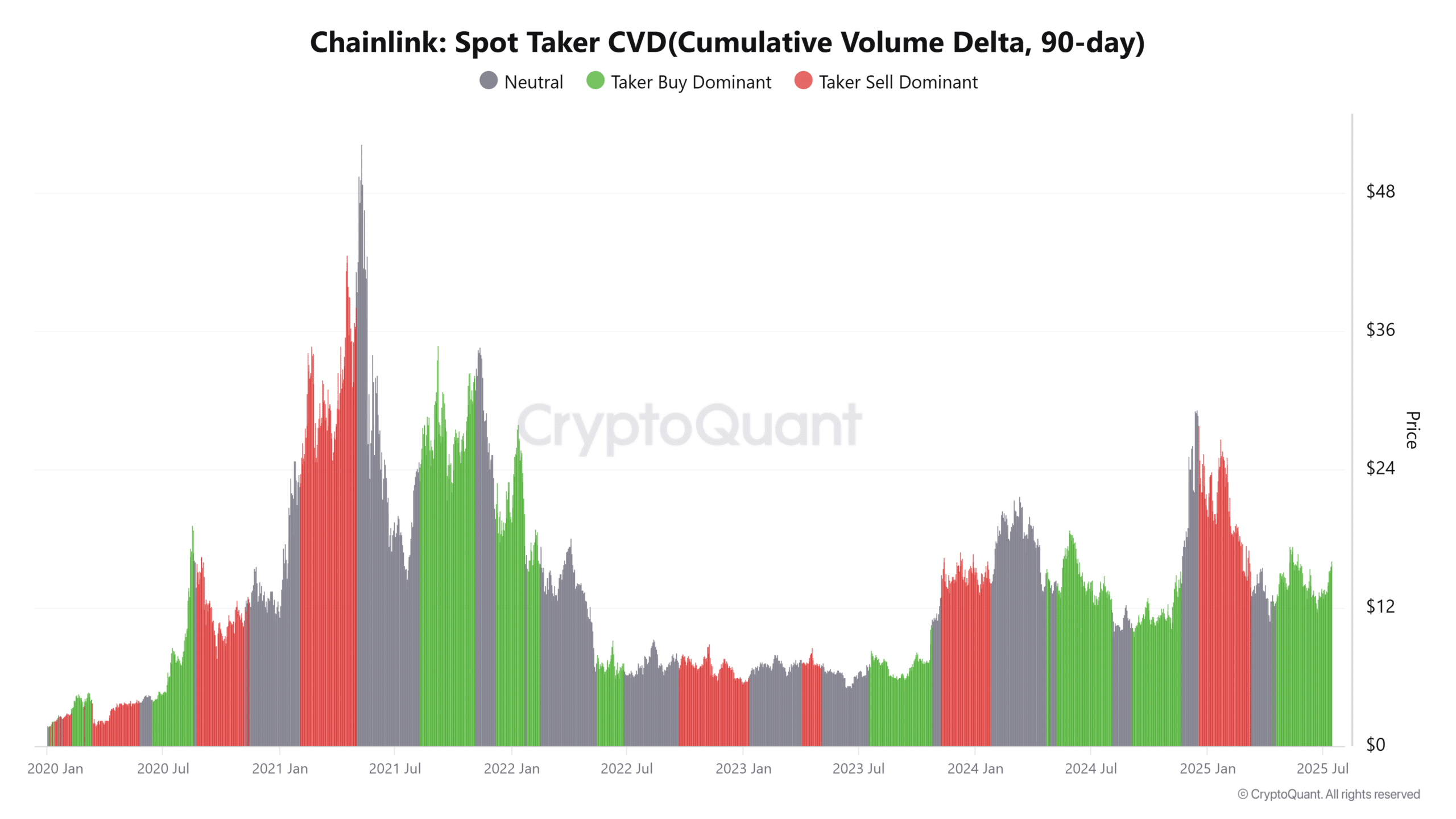

Taker Buy Volume Dominance continues to favor bulls, as shown by the positive Spot Taker CVD over a 90-day window.

Naturally, this suggests that aggressive buyers continue to outpace sellers in LINK’s spot markets—a trend that often supports continuation rallies.

However, this metric alone won’t guarantee a breakout. Without a spike in exchange-wide activity, momentum may stall.

Still, market taker dominance signals firm demand behind LINK’s recovery.

Do THESE ratios suggest overheated conditions?

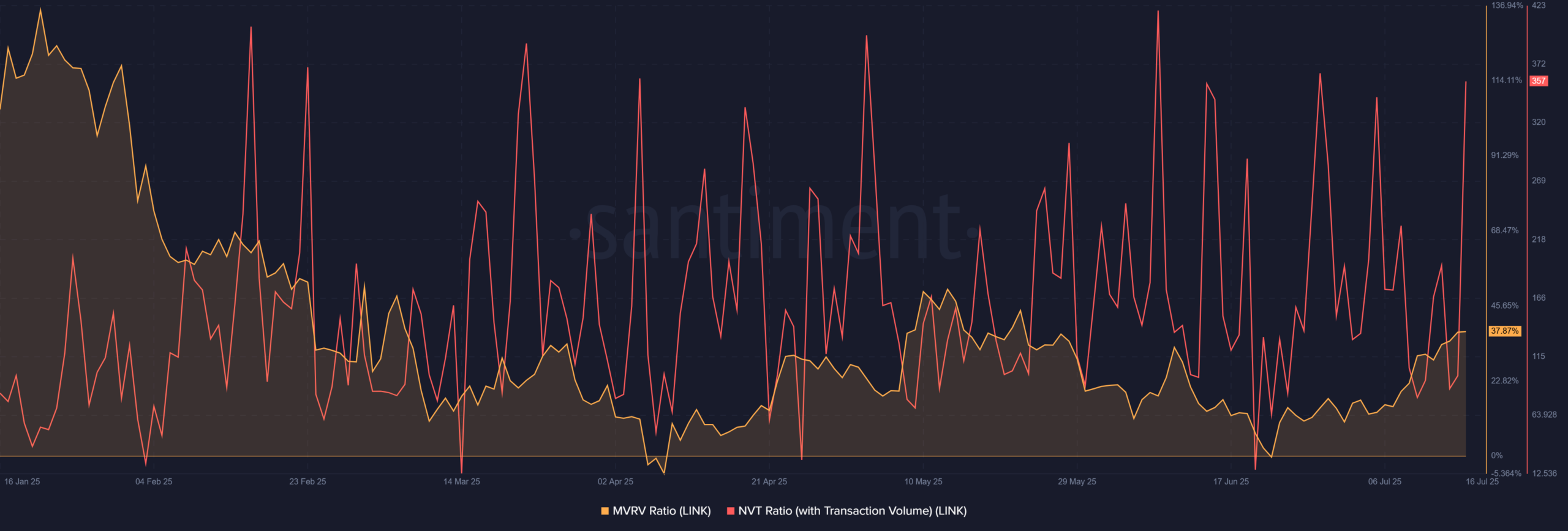

The MVRV Ratio climbed to 37.87%, at press time, placing most holders in profit territory. Historically, such levels have triggered localized tops as profit-taking kicks in.

Additionally, the NVT ratio has seen repeated spikes, which typically signal a disconnect between price and actual network activity.

While rising prices can reflect optimism, surging NVT suggests price may be outpacing on-chain utility.

Therefore, although bullish sentiment remains high, LINK might be entering a speculative zone where cautious traders should monitor for potential reversals.

What does the flip in funding say about market sentiment?

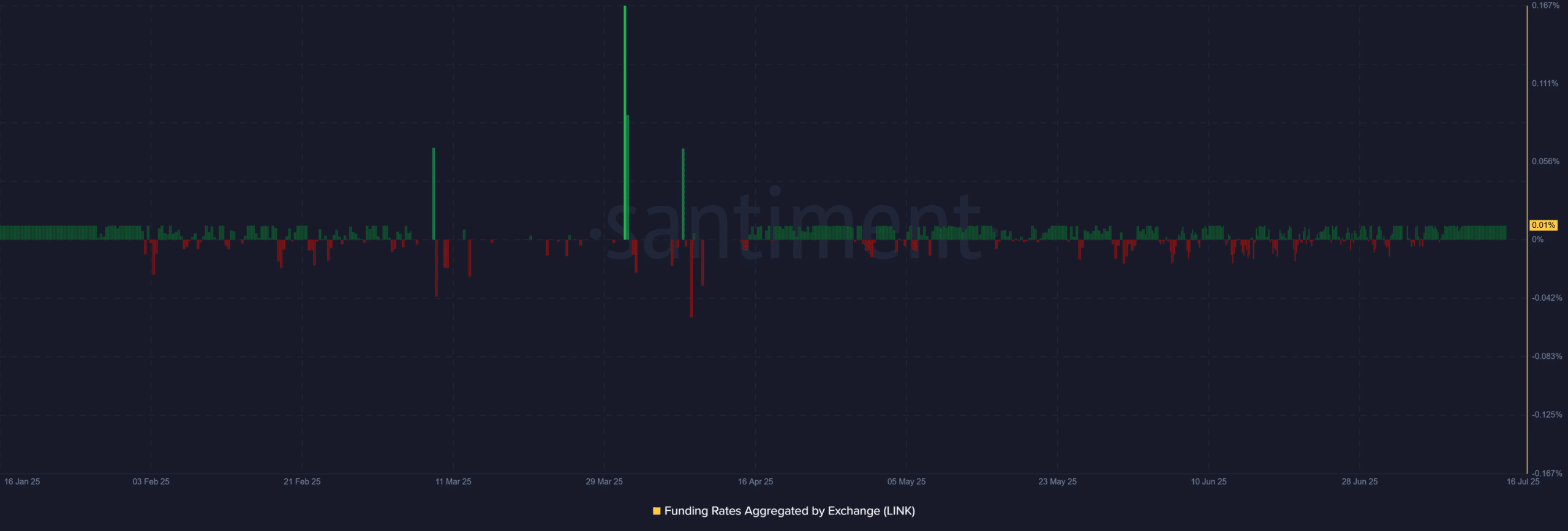

After weeks in the red, Funding Rates flipped positive, as of writing, reflecting a growing preference for long positions on derivatives platforms.

Naturally, positive Funding means traders are willing to pay a premium to stay long. It also suggests improved trader confidence.

But that confidence comes with risk. If price stalls, those same longs could face liquidation pressure.

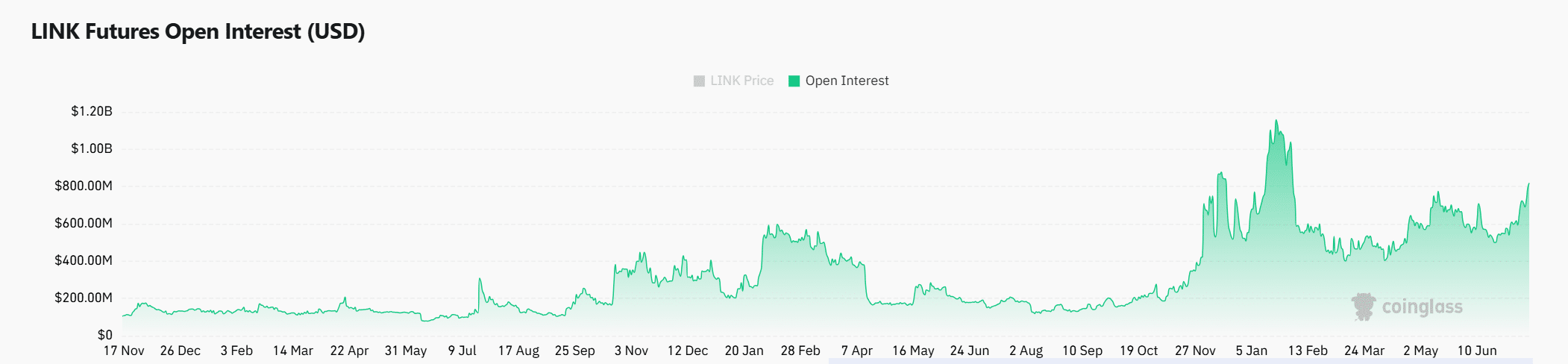

Is rising Open Interest fueling momentum or raising volatility risks?

At the time of writing, Open Interest (OI) jumped 8.47% in the last 24 hours to $843.05 million, showing strong participation from derivatives traders. This rise indicates a growing speculative appetite and aligns with the ongoing price surge.

However, elevated OI can also signal potential volatility, especially if over-leveraged positions get liquidated.

The Binance Heatmap revealed clustered liquidations just below the $17 zone, suggesting that a breakout or rejection could trigger rapid price moves.

Therefore, while momentum remains bullish, caution is advised near resistance.

Can LINK break free, or will the range trap persist?

Chainlink is showing renewed strength as bulls push toward a key resistance level near $17.50. Spot demand, funding, and OI all support a bullish outlook.

However, on-chain metrics and clustered liquidations suggest that a rejection remains possible.

Whether LINK flips this range into support or faces another rejection will define its short-term trend trajectory.